I don’t understand the market value of Naspers. I haven’t for two years.

Today, Naspers trades at a market value of $98.8 billion. Naspers owns roughly 33% of Tencent. Today, Tencent has a market value of $419.5 billion. Meaning that per the market’s own pricing, Naspers owns $139.7 billion of Tencent. Think on that for a minute.

The market is implying that Naspers’ core businesses in combination with its management team are worth a -$40.9 billion. That’s a negative $40.9 billion.

Let me try that again: the global public capital markets say that Tencent is worth $419.5 billion. Even though Naspers owns 1/3rd of this business mathematically equivalent to $139.7 billion in market value, it is being priced as only worth $98.7 billion.

According to this article and to IR at Naspers, the Tencent holding is held in a non-taxable offshore structure. So presumably, this is not a discount given by the market that is related to a deferred tax liability on a large capital gain realization if/when the position is sold.

A conundrum – at least to myself and Steve (see pg. 3).

Tencent is a fantastic business and I’d love to own it outright. You can read about it here as I won’t go into it.

Naspers is South African media and technology business with annual revenues in the billions. The business is less than free. In fact, the market says I can get paid to own this business. Naspers doesn’t only own Tencent, it has sizable investments in real businesses like Flipkart, and in public businesses like Mail.ru and MakeMyTrip. They have even gone so far as proving their businesses have value by disposing of one (Allegro) last year for $3.3 billion.

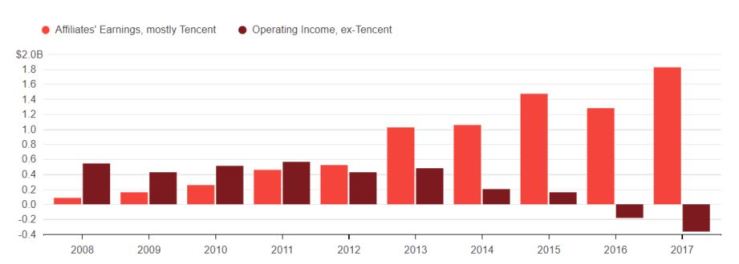

Because the business uses equity-accounted results and includes gains on acquisitions/disposals it shows a handsome annual profit in the billions. In reality, if we exclude those contributors, the business runs at an operating loss. For example, if we exclude Tencent’s contribution to the bottom line – which we might consider doing being that it is a non-controlling passive ownership on a (lucky) investment made 15 years ago – last years financial results move from a $2.7 billion profit to a $379 million loss. Though the Chairman doesn’t believe they should be excluded. If we look at the past two years, the company has been bleeding cash when we strip out the gains in Tencent.

Chairman Bekker said that the assumption that Tencent is making money and Naspers’s other ventures are loss-making was “illiterate,” since profitability “doesn’t accurately capture the value of the businesses”. Questionable. He also said the biggest internet companies grow faster in both China and the U.S. and that the argument for breaking up technology companies is flawed.

“Amazon, for instance, has made losses at times,” Bekker said. “The link between short-term profitability and value is simply not there.” He’s definitely cherry picking his comps.

So, we have a business who has lost money for the past couple of years (when we exclude Tencent’s contribution).

This happens to be about the same time frame of the price decoupling between Naspers shares and Tencent shares.

The market might have a reason to be skeptical. Since 2005, Naspers has spent about $8.5 billion on acquisitions and has only had about $4.9 billion in dispositions. Since 2015, the company has increased its shares outstanding by about 6.5% and since 2010, by over 12%. Each owners’ claim on the business is getting smaller.

Perhaps shareholders simply need to see more dispositions, or perhaps the underlying business (ex-Tencent) needs to return to profitability. Either way, Naspers probably needs to prove it’s running on more than luck for the discount to close. There is one more possibility that could explain some of the dislocation: Chinese “investors”. As Shuli Ren at Bloomberg points out, mid-July to mid-August saw mainlanders buying a net $767 million ($6 billion HKD) of shares alone. Euphoria and momentum have had a strong and recent showing in Chinese markets (as seems common with developing markets coming to maturity) and perhaps it’s shown up more recently in demand for the Asian listed Tencent shares. If the stock loses large inflows or momentum, perhaps a narrowing might occur.

So, how much optimism is in the price?

Negative $40.9 billion.

The real question: Is that too much pessimism?

Postscript:

Hypothetically, if one wanted to assume or wager that the future market garners less pessimism about Naspers and begins allowing rationality to prevail (unless I’m missing something HUGE) one might consider shorting Tencent and going long Naspers on roughly a 1:1 dollar ratio. Because the discount is presumably silly at $40+ billion, I’m choosing to ignore Naspers other businesses. I’m also assuming there’s not some giant liability I am missing from Naspers. Naspers ownership in Tencent has a market value of $141.4 billion. Naspers market cap is $98.7 billion. That’s all we’ll focus on.

When I buy these businesses, I am buying a percentage of them outright for a certain dollar amount – forget the shares. If I am buying Naspers for $98 I might short $98 worth of Tencent. That way, if the discount closes by way of Naspers increasing to parity with Tencent, my short will be on for $98, though my long will now be worth $141.40. Or let’s say Tencent falls to parity with Naspers. My long on Naspers will be worth $98, my short on Tencent will have moved to the $60’s.

***As is forever and always the disclaimer, this is not investment advice. Do your own work and verify your own numbers. I might buy, sell, or ignore anything at any time and have no obligation to update anything on this site.***

I agree 100% with Mark.

https://www.bloomberg.com/news/articles/2017-10-10/naspers-should-buy-own-stock-to-exploit-tencent-gap-mobius-says

LikeLike

https://seekingalpha.com/news/3315116-naspers-profits-jump-boost-one-third-tencent-stake. Naspers still losing money ex-tencent. To the tune of $200m. Expect a bit more stock issuance until (if) they get their other businesses profitable.

What? Naspers is “working hard” to narrow the difference between the value of its business and the one-third stake in Tencent, CFO Basil Sgourdos tells Bloomberg: “The discount is at an unusually high level, and there is no reason for the discount to be at this level.” Working hard would be realizing gains for spinning out the position.

LikeLike

https://www.bloomberg.com/news/articles/2017-12-12/naspers-could-consider-structural-options-to-reduce-discount

LikeLike

Naspers selling a bit of Tencent (2% of holdings for a bit over $10 billion). I would be excited that management is getting reasonable, but instead of using the proceeds to turn around and buyback Naspers shares at a $50 billion discount, they’re going to plow the proceeds into classifieds, online food delivery, and fintech. All the businesses that consume cash and don’t have a clear monetization strategy. After all, why pick up free money on the sidewalk in front of you when you can take operational and execution risk? Ah, yes. They must look like they are doing something vs. nothing. It’s just too easy to take the rational and logical route.

Not happy with Naspers one-track mind. https://www.naspers.com/home/news/accelerated_offering_of_tencent_shares_and_caution

LikeLike

Maybe I should be short Naspers and long Tencent. After selling $10 billion worth of Tencent, Naspers management still refuses to buy back their own stock at a $50 billion discount. Unbelievable.

https://www.bloomberg.com/news/articles/2018-03-23/naspers-mulls-listing-units-on-market-after-tencent-share-sale

LikeLike